This is breaking news. Please check back for updates.

3M shares jumped Tuesday after the manufacturing conglomerate reported first-quarter earnings and revenues that topped Wall Street’s expectations as demand for safety equipment and cleaning products spiked amid the coronavirus pandemic.

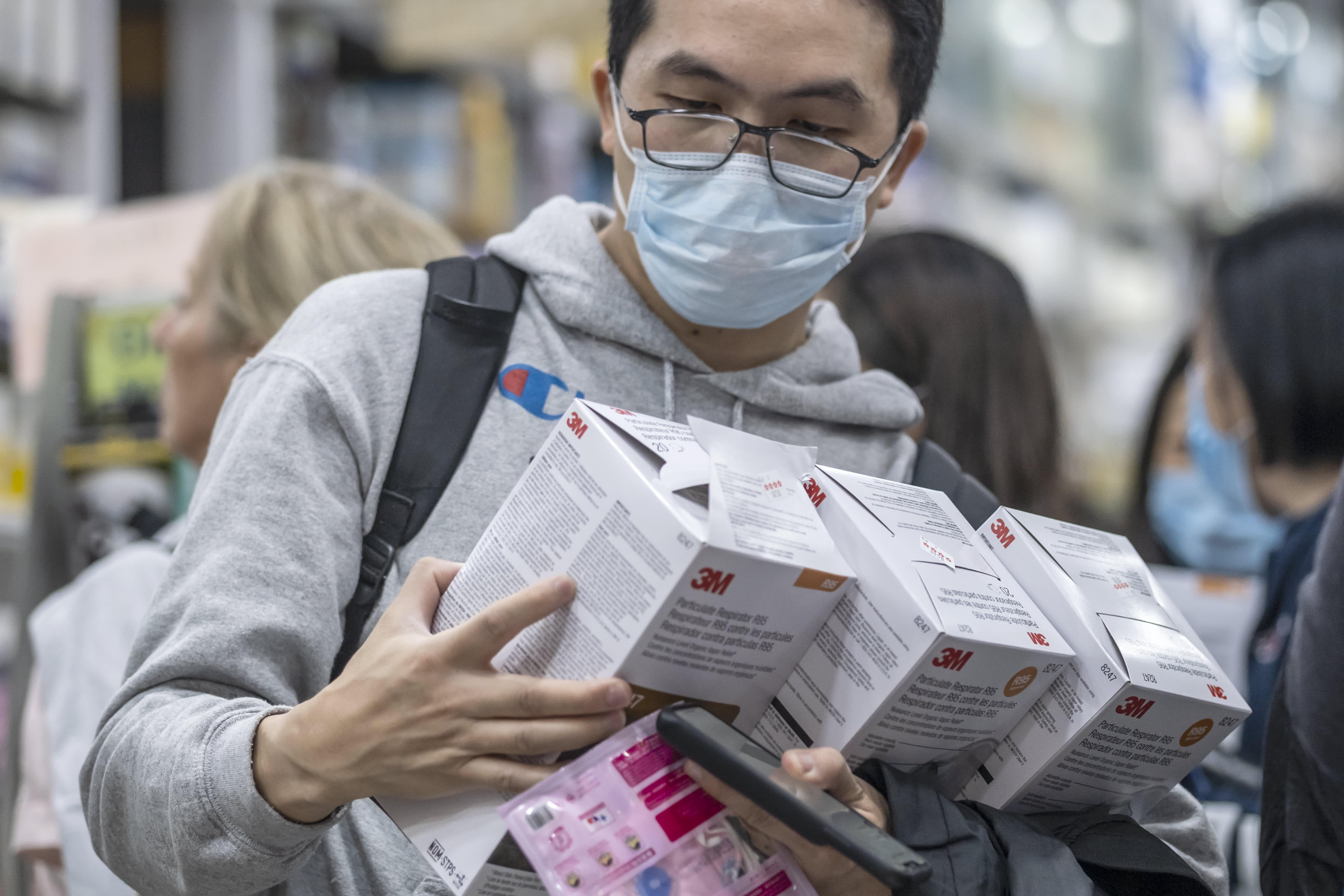

The company said in a release that it saw a mix of results across its segments, but especially “strong” numbers in its personal safety unit given its role in the production of key N95 respirator masks amid the global Covid-19 outbreak.

The St. Paul, Minnesota-based 3M said Tuesday that it’s doubled global respirator output to 100 million per month since the beginning of 2020 and is increasing capital investment to double respirator out again.

It reported adjusted earnings per share of $2.16 on revenues of $8.08 billion for the first quarter, growth of 2.7% on a year-over-year basis. Both figures topped Wall Street consensus estimates of EPS of $2.03 and sales of $7.91 billion based on Refinitiv research.

However, it’s difficult to compare reported earnings to analyst estimates for 3M’s first quarter as the impact of the coronavirus is tricky to model precisely in financial forecasts. Shares were last seen up 3.8% in premarket trading.

“Given the breadth and diversity of our businesses, the financial impact of COVID-19 is varying across 3M,” CEO Mike Roman said in a release.

“In the first quarter we saw strong growth in personal safety, as well as in other areas of our portfolio experiencing high demand due to the pandemic,” he added. “At the same time, we experienced weak demand in several end markets that were more severely impacted by actions taken around the world to slow the pandemic.”

Total sales grew 21% in its health-care segment and 4.6% in consumer, the company said.

As such, 3M announced Tuesday that it is withdrawing its full-year financial guidance, saying uncertainty about the duration, magnitude and pace of recovery from the Covid-19 pandemic makes it impossible to provide meaningful estimates.

The conglomerate said it would begin reporting monthly sales information starting in May to provide investors transparency on 3M’s ongoing business performance.

The Trump administration and public health officials have been laser-focused on 3M in recent weeks as it ramps production of its N95 masks that that filter small particles and droplets from the air. The masks have proven exceptional for their ability to protect wearers from contracting the infectious coronavirus.

The N95 masks have proven so important to the public health campaign that President Donald Trump ordered 3M to accelerate their production after invoking the Defense Production Act on April 2.

The president also tweeted that same day that the administration “hit 3M hard today after seeing what they were doing with their Masks,” a comment that appeared to refer to the company’s move to sell some of their N95 masks to Canada and Latin America.

A few days later, Trump announced that the White House and 3M had reached an agreement that included the government’s purchase of nearly 167 million masks over the next three months. 3M continues to ship N95 masks around the globe to continue to fill global orders.

“We share the same goals of providing much-needed respirators to Americans across our country and combating criminals who seek to take advantage of the current crisis,” Roman said on April 6. ”Given the reality that demand for respirators outpaces supply, we are working around the clock to further expand our capacity, while prioritizing and redirecting our supplies to serve the most critical areas.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.