WEST HOLLYWOOD, CALIFORNIA – OCTOBER 22: People watch a broadcast of the final debate between … [+]

Getty Images

Much ink is being spilled about what a Democrat or a Republican presidential result could mean for the stock market. This is a waste of ink. Past elections show that economic and financial circumstances are far more influential on stocks than who wins the White House.

The 2020 election is no different. Today’s world features one of the worst U.S. recessions on record, a global pandemic and a mountain of stimulus money leaking into the stock market. These monumental conditions eclipse the relevance of what party ends up in the White House with regards to stocks.

Some point out that the stock market climbed to record highs after Donald Trump replaced Barack Obama. This is true, but it is also true that starting in 2013 the stock market consistently broke record highs for four straight years under Barack Obama, despite the vastly different tax and regulatory policies of the two administrations.

The opposite happened in the election of 2008: a Democrat replaced a Republican, when the market was in the midst of a major decline triggered by the Financial Crisis. Polls showed John McCain gaining over Barack Obama between October 2007 and July 2008, and then falling behind from then until election date. Neither the changing polls nor the outcome of the ballots seemed to alter the course of the S&P 500, which shed 55% during a painful 15-month bear market that straddled the election.

The election of 2000 that replaced Democrat Bill Clinton with Republican George W. Bush happened right after a bull market that ran virtually uninterrupted for at least 10 years and accelerated towards the end. As such, it was pretty much close to exhaustion. By the time Bush was elected, the internet bubble had already burst and the market went on a long downward slide.

In the last 20 years, the actual results of election night had little impact on the market. Of course, policies specific to each combination of executive and congressional control eventually have an effect on stocks, but this takes time.

Some, for instance, insist that tax and regulatory policies strongly influence market direction. This claim is very difficult to verify with any kind of precision, so it is often heavy on policy and political preferences rather than facts.

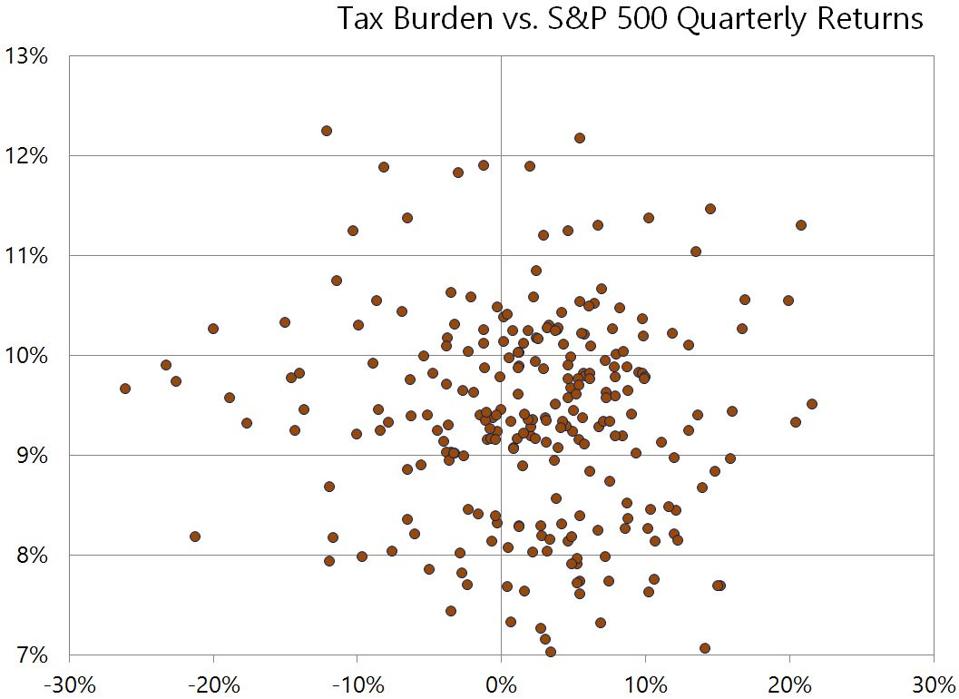

For example, tax burden can be measured as the sum of federal, state and local tax collection as a percentage of GDP. This gauge fell at the beginning of the G.W. Bush and Barack Obama administrations, simply because of the recessions that were raging each time and decimated stocks. In other words, tax burden went down because the economy shrank, inverting the expected direction of causality. Conversely, tax burden increased significantly during Bill Clinton’s tenure, but stocks had one of the fastest sustained bull markets on record. There is virtually no correlation between tax burden and stock market returns.

Tax burden, or the sum of federal, state and local tax receipts as a percentage of GDP, show no … [+]

Path Financial LLC, Federal Reserve Bank of St. Louis

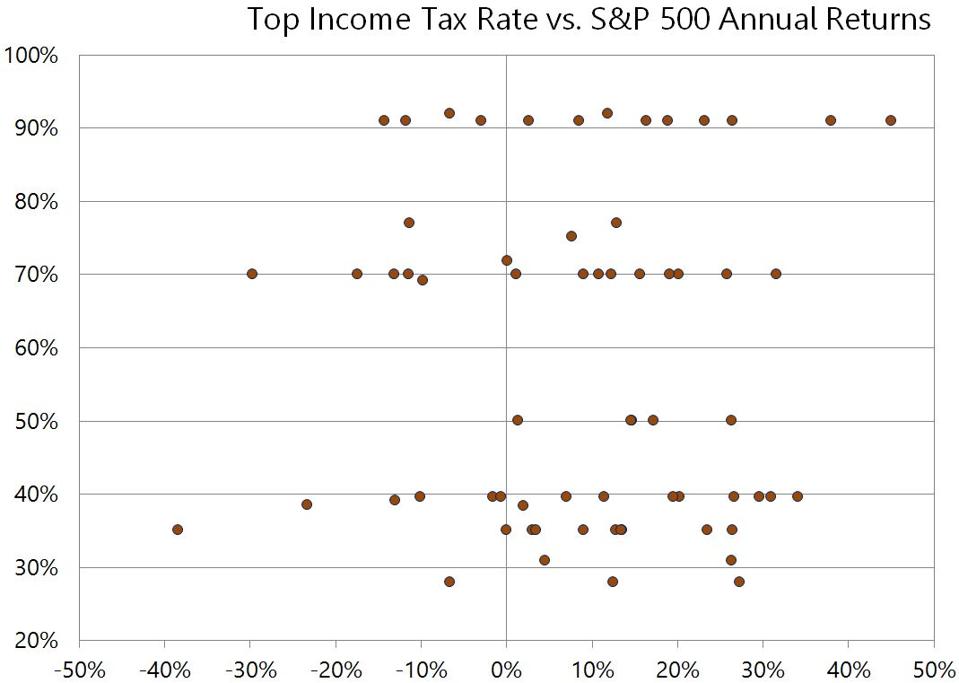

There also seems to be little relation between income tax rates and stock market direction. In the 10 years between 1953 and 1963 stocks rallied more than 200% while the top marginal tax rate was 91%, but lost 20% in the next ten years when rates were lowered to “just” 70%, for example. In fact, the highest one-year return took place in 1954 when the highest tax bracket was highest (91%), and the lowest return was in 2009, when the top rate was at one of its lowest levels (35%).

The highest annual return of the S&P 500 took place when the tax rate for the top income bracket was … [+]

Path Financial LLC, Federal Reserve Bank of St. Louis

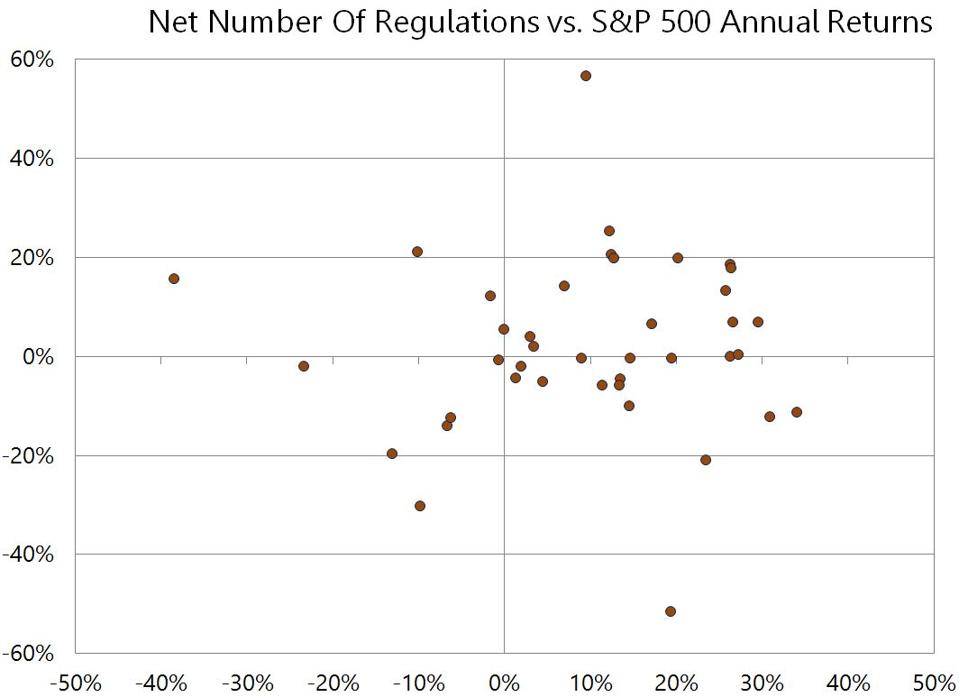

It is also difficult to say how or whether regulations affect stock prices, especially because “regulatory burden” is difficult to define. Some use the Federal Register page count, but this picks up a lot of irrelevant verbiage and it is guaranteed to correlate positively with the stock market since the number of pages has gone up over time. A better measure would be the net number of new rules every year: do more rules weigh down on stocks? Alas, there is no relationship between the increase or decrease in the number of regulations and stock market returns. This is also the case when comparing only the number of “economically significant” regulations against stocks.

Placing or eliminating regulations does not seem to affect stock market returns.

Path Financial LLC, Congressional Research Service

Are stocks then completely indifferent to who wins an election?

One example of a tax that may have an impact on investor behavior in the upcoming 2020 presidential election would be an increase in the capital gains tax rate if Joe Biden, the Democrat, wins. The suggestion is that long-term holders of stocks would rush to liquidate positions to realize long-term gains before higher rates kick in.

It seems not likely, however, that investors would incur a large tax bill just because the tax rate will go up. As long as a stock remains on the books, the capital gains tax rate is irrelevant, and many would prefer to pay the tax liability as they go rather than all at once. Another caveat is that realizing long-term gains does not automatically reduce holdings. More likely, investors who realize gains immediately will replace old holdings with new ones (subject to wash-sale rules). This will have little or no effect on the direction of the market.

Another important issue relating to this year’s election is that more stimulus is needed to blunt the effects of the Covid-19 pandemic. Everyone agrees with this, at least in principle, so it does not seem to depend on who wins. This is one of the key issues sustaining the value of stocks. One particularly bad outcome would be if parties split the White House and the Senate, guaranteeing gridlock at a time when action is sorely needed.

Finally, a vaccine against Covid-19 would be the clearest shortcut to recovery and to higher stock prices, another issue that today is far more important than who wins on election night, as far as stock prices are concerned.

It’s important to remember that stocks tend to go up over time, as it has been amply demonstrated, and that there is no magical mix of party control of the White House and Congress that produces the best combination of solid returns with low volatility.

This does not mean that policies are unimportant; on the contrary, they are. The stock market has gone up for decades upon decades because both parties have been remarkably consistent on the policies, institutions and frameworks upon which the U.S. rests. Which means that they must be preserved if we want to have many more decades of prosperity.