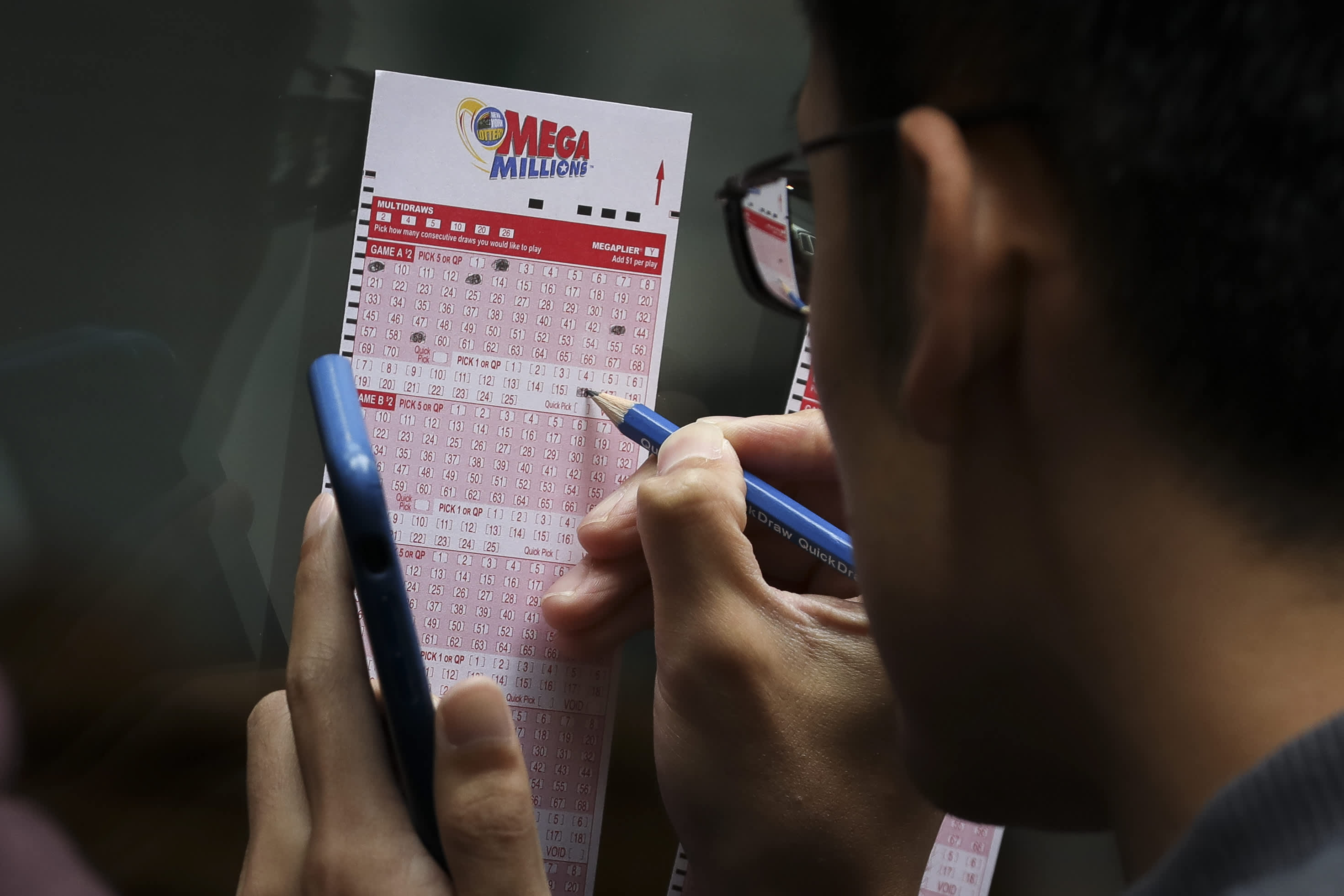

Drew Angerer | Getty Images News | Getty Images

No, you didn’t hit the $520 million Mega Millions jackpot.

The lottery game’s top prize has climbed to a whopping $600 million for Tuesday night’s drawing, following no ticket matching all six numbers drawn Friday night. The amount marks the 8th-largest jackpot in lottery history. And Powerball’s jackpot, meanwhile, is an estimated $470 million for Saturday night’s drawing.

Of course, the advertised amounts are not what winners would end up with. Lottery officials are required to withhold 24% of big wins for federal taxes. And that’s only the start of what you would pay to Uncle Sam and, typically, state coffers.

More from Personal Finance:

Some newlyweds face a marriage tax penalty

Here are three of my worst money mistakes

Avoid mistakes when divvying up assets in divorce

For the $600 million Mega Millions jackpot, the cash option — which most winners choose instead of an annuity — is $442.4 million. The 24% withholding would shave about $106.2 million off before the prize reaches you.

However, you could count on owing more to the IRS.

The top marginal income tax rate is 37%. If there were no reductions to the winner’s taxable income — such as large charitable contributions — another 13%, or $57.5 million, would be due to the IRS at tax time (which would be April 2022 for jackpots claimed in 2021).

That would be $163.7 million, in all, going to the IRS.

State taxes would be on top of that. Depending on where you live, that hit could be more than 8%.

Meanwhile, for Powerball’s $470 million jackpot, the cash option is $362.7 million. If there’s a winner, the 24% federal withholding would shave $87 million off the top. Another 13% would be $47.2 million, for a total of $134.2 million for the taxman.

Despite handing over a sizable amount to federal and state coffers, the after-tax amount would be life changing. Experts say jackpot winners should assemble a team of experienced professionals — including an attorney, a tax advisor and a financial advisor — to help navigate their sudden wealth.

Most players won’t have to worry about it, however. The chance of hitting the Mega Millions jackpot with a single ticket is miniscule: 1 in 302 million. For Powerball, the odds are slightly better: 1 in 292 million.