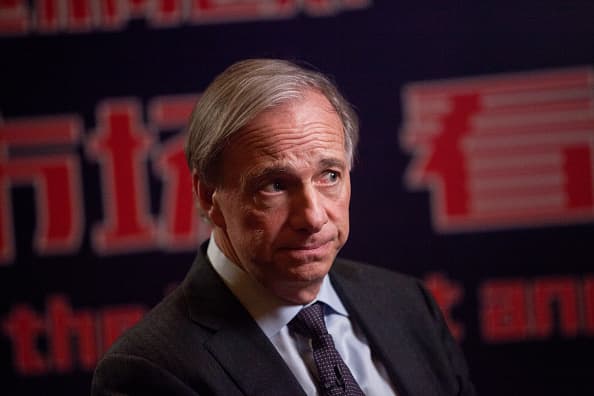

China expert George Magnus disagrees with Bridgewater Associates’ Ray Dalio on Beijing’s tech crackdown.

In a LinkedIn post this month, Dalio said investors were misconstruing a clampdown by China on sectors including fintech, online tutoring and food delivery as “anti-capitalist.”

“The trend over the last 40 years has clearly been so strongly toward developing a market economy with capital markets, with entepreneurs and capitalists becoming rich,” the billionaire hedge fund manager said.

“As a result, they’ve missed out on what’s going on in China and probably will continue to miss out,” Dalio added.

Magnus thinks Dalio is mistaken. The economist, who is an associate at the University of Oxford’s China Centre, told CNBC on Wednesday that Beijing’s crackdown is all about the Communist Party’s pursuit of political “control.”

“I think Dalio is wrong,” Magnus told CNBC’s “Street Signs Europe.” “Obviously he’s got a big business in China, so he would say that, wouldn’t he?”

Neither Dalio nor Bridgewater Associates was immediately available for comment at the time of publication.

Dalio has made a number of bullish comments on China over the past year. In October, he warned investors not to ignore China’s rise as an economic superpower. Meanwhile, Bridgewater Associates has been ramping up investments into China’s stock market lately.

And, despite China’s scrutiny of its massive tech sector, Dalio is doubling down. “Don’t misinterpret these wiggles as changes in trends, and don’t expect this Chinese state-run capitalism to be exactly like Western capitalism,” he said recently.

China’s Communist Party is “basically driven to control these tech firms and entrepreneurs, despite the fact that they are the essence of the dynamism of China’s economy,” Magnus said.

Entrepreneurs like Alibaba founder Jack Ma and Tencent chief Pony Ma are “supposed to support the party’s goals,” he added.

China’s move to ramp up oversight of its tech industry began last year when comments from charismatic billionaire Ma criticizing regulators forced Ant Group, the fintech affiliate of Alibaba, to scrap its planned initial public offering.

Speculation mounted over Ma’s whereabouts after he disappeared from the public eye for months. According to associates, the entrepreneur is lying low. In June, Alibaba co-founder Joe Tsai told CNBC Ma was “doing well” and had “taken up painting as a hobby.”

More recently, Beijing has extended its crackdown to several other companies. Ride-hailing firm Didi, which went public in the U.S. earlier this year, has fallen 38% below its offering price on the back of a cybersecurity probe from Chinese regulators.

Authorities have also targeted private tutoring services, food delivery firms and the video game industry.

“What we generally regard as growth stocks and growth companies … they won’t and they shouldn’t trade as growth stocks because they have been politicized,” Magnus said. “Capital is being politicized in China.”

“The valuation lurch that we’ve seen since February in many of the stocks in China is pretty permanent,” he added. “I don’t think that the valuations in China, a lot of the tech stocks, actually should be where they used to be.”